Limited Public Service Loan Forgiveness (PSLF) Waiver Ending Soon

The process of receiving student loan forgiveness is notorious for being overly complicated. Last fall, however, the Biden administration temporarily updated the rules regarding public service loan forgiveness. These time-limited changes now make it easier for more borrowers to receive student loan debt relief, but there is one catch. These changes, known as the Limited PSLF Waiver, will expire on October 31, 2022. Keep reading to see if you qualify for relief and what steps you need to take before the program ends.

Overview of PSLF Waiver Changes & Requirements

The PSLF Waiver is a temporary program designed to help public service workers get closer to student loan debt forgiveness. It relaxes the rules for both PSLF Program and the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) Program. As of August 2022, 211,370 borrowers qualified for forgiveness under the new waiver program. Combined, they had over $12.8 billion in student loan debt forgiven.

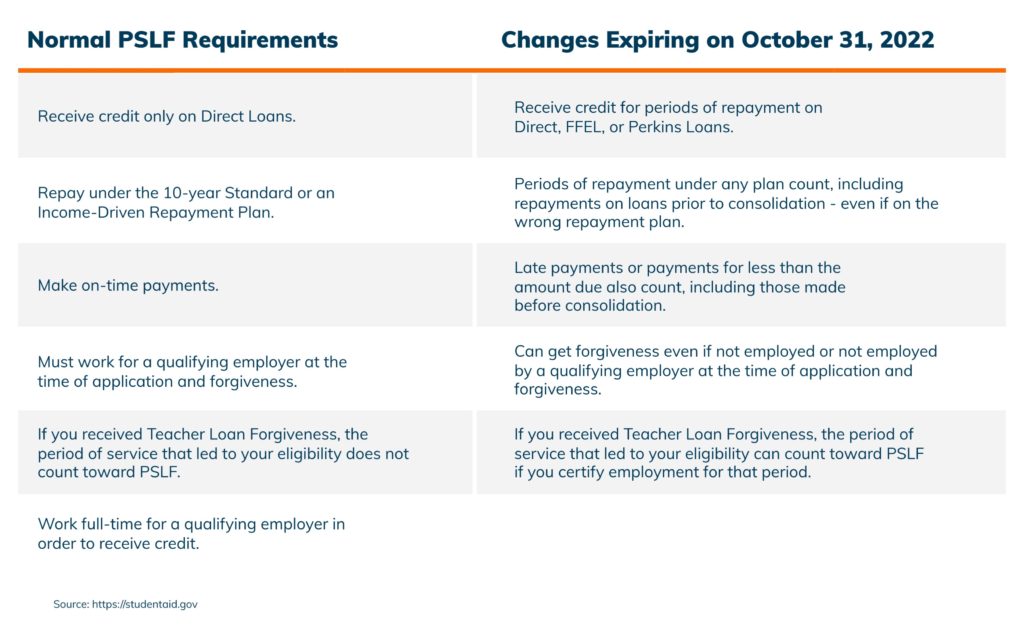

Here’s what’s changed and what’s stayed the same as of October 6, 2021.

If you have FFEL, Perkins, or other federal student loans, you’ll need to consolidate them into a Direct Consolidation Loan to qualify for PSLF. This is true for both the general program and the new limited waiver rules described above. Before consolidating, make sure you work for or were previously employed by a qualifying employer.

Unchanged Requirements

Several rules under the general program still apply under the limited waiver, as well. To qualify, you must:

- Make 120 qualifying payments or the equivalent

- Be employed by the government, 501 (c)(3) not-for-profit, or other non-profit organization that provides a qualifying service

- Work full-time (30 hours or more per week, or you meet your employer’s definition of full-time, whichever is greater)

- Have Direct Loans or consolidate into a Direct Consolidation Loan

- Certify qualifying employment for the periods you seek to credit toward PSLF

Only repayment periods after the PSLF Program began (October 1, 2007) are eligible for credit.

Qualifying Payments: New Time-Limited Rules

Under the Limited PSLF Waiver rules, any prior period of repayment will count as a qualifying payment, regardless of loan program (excludes Parent PLUS loans), repayment plan, or whether you made the payment in full or on time. And, you will continue to need qualifying employment.

Forbearance periods of 12 consecutive months or longer, or 36 cumulative months or greater will count under the waiver program. Forbearance periods provided under COVID-19 emergency relief are not included in these months. Economic hardship deferment on or after January 1, 2013, as well as any deferment before 2013, will count under the waiver. In-school deferment and periods of default do not qualify.

These changes will apply to borrowers with Direct Loans, those who have already consolidated into the Direct Loan Program, and borrowers who consolidate into the Direct Loan Program by submitting a consolidation application on or before 11:59 p.m., Eastern time on Oct. 31, 2022.

PSLF Waiver Next Steps

The deadline to apply for the Limited PSLF Waiver is October 31, 2022. The good news is even if you just learned about the program, there’s still time to take advantage of it. Here’s what you need to do next.

- Find out which loans you have. You can do this by logging into your Federal Student Aid (FSA) account and scrolling down to the “Loan Breakdown” section.

- Verify your employer is eligible by checking the PSLF Employer Search. If your employer is “eligible” or “likely ineligible” (which means their eligibility is undetermined), but you believe the employer qualifies – move to step 3.

- Apply for a consolidated loan (if applicable). If you have FFEL, Perkins, or other federal loans, you’ll need to apply for a Direct Consolidation Loan ASAP! Although the loan doesn’t have to be approved by the deadline date, your application must be submitted by 11:59 p.m. EST on 10/31/22.

- Submit your Employment Certification Form. Your PSLF Employment Certification Form must be dated October 31, 2022, or earlier. If you use the PSLF Help Tool to generate the form before the deadline, you’ve met the requirement even if your employer signs it after that date. You also meet the requirement if it’s signed by the deadline but submitted after October 31.

- Make sure you’re on an eligible repayment plan moving forward. Once the limited waiver program ends, you’ll need to be on one of four income-based repayment plans to ensure your future payments are properly credited under the regular PSLF program: Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), Pay as You Earn (PAYE), or Revised Pay As You Earn (REPAYE). Although the Standard Repayment Plan also qualifies (except for consolidation loans), there’s really no benefit when it comes to PSLF. This is because your loan is typically paid off in 10 years (120 payments), resulting in a $0 balance to be forgiven.

Don’t forget to follow up; mistakes happen. If you haven’t received any communication about your request within a few weeks after submission, call your loan servicer to verify that they have everything they need to process your application.

Where to Get Help

If you have questions about the Limited PSLF Waiver or your eligibility, a good place to start is with MOHELA (PSLF servicer). The Department of Education also offers resources to help you through the employer certification and documentation process. You can also give MoneySolver a call at 855-476-6920. We offer a free consultation and can help you apply for the Limited PSLF Waiver, as well as put you into the appropriate repayment plan moving forward.